Property Tax Rate In Hillsborough County Fl . In unincorporated areas, the total. These increases led to an overall county property tax rate increase of about 7 cents per $1,000 in appraised taxable property value. What is the hillsborough county property tax rate? Taxes are levied in hillsborough county by the taxing authorities empowered to do so by the state legislature. Our hillsborough county property tax calculator can estimate your property taxes based on similar properties, and show you how your property tax. The hillsborough county fl property tax rate is $5.7913 per $1,000 of assessed value. Taxes are assessed by the property appraiser as of january 1 of. Locally elected officials florida has more than 640 local governments that levy a property tax. The median property tax (also known as real estate tax) in hillsborough county is $2,168.00 per year, based on a median home value of. The property appraiser establishes the taxable value of real estate property.

from danyellejwelchxo.blob.core.windows.net

Locally elected officials florida has more than 640 local governments that levy a property tax. Our hillsborough county property tax calculator can estimate your property taxes based on similar properties, and show you how your property tax. Taxes are levied in hillsborough county by the taxing authorities empowered to do so by the state legislature. The hillsborough county fl property tax rate is $5.7913 per $1,000 of assessed value. These increases led to an overall county property tax rate increase of about 7 cents per $1,000 in appraised taxable property value. The property appraiser establishes the taxable value of real estate property. Taxes are assessed by the property appraiser as of january 1 of. What is the hillsborough county property tax rate? In unincorporated areas, the total. The median property tax (also known as real estate tax) in hillsborough county is $2,168.00 per year, based on a median home value of.

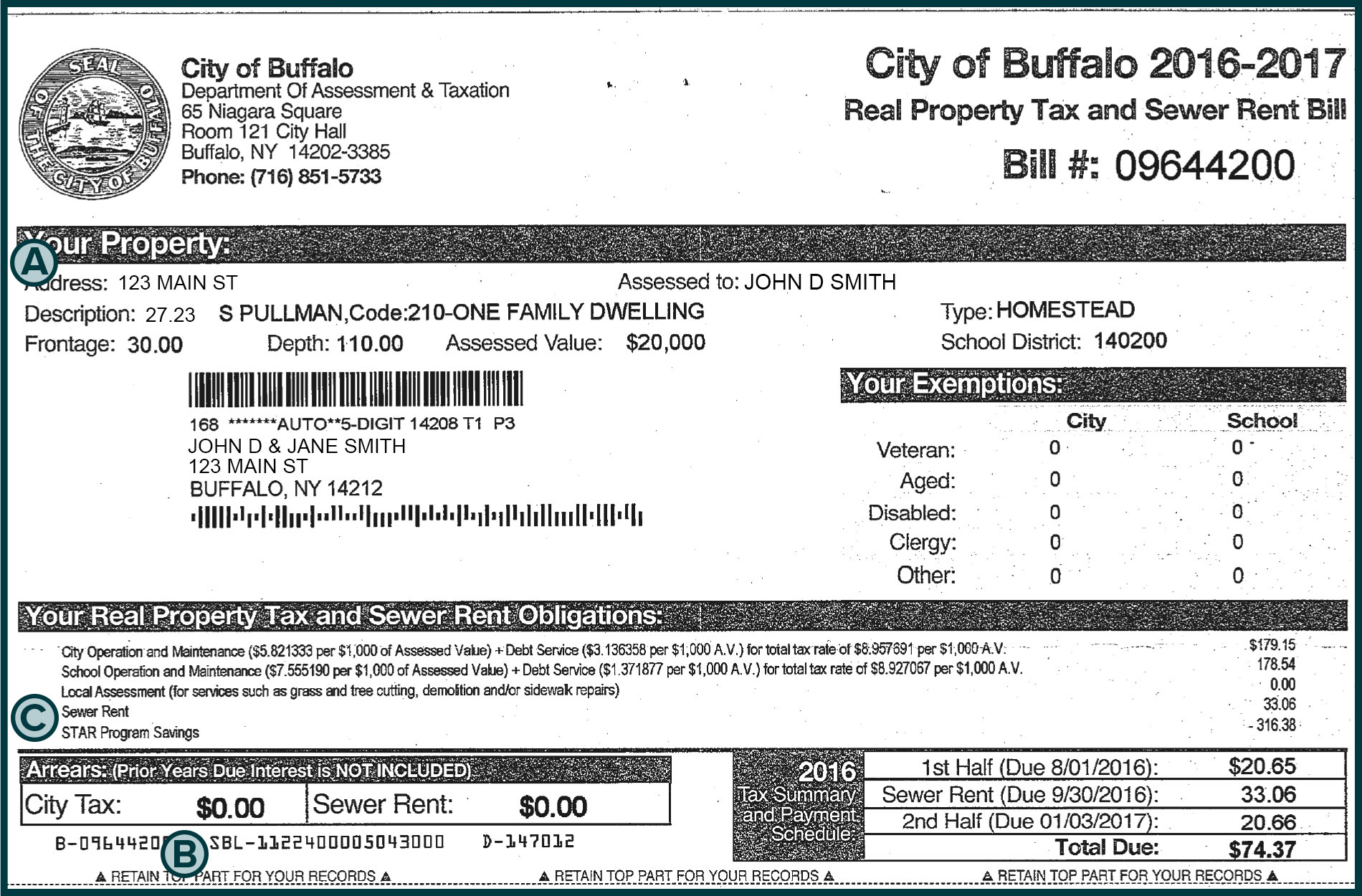

Davis County Property Tax Bill

Property Tax Rate In Hillsborough County Fl The hillsborough county fl property tax rate is $5.7913 per $1,000 of assessed value. The median property tax (also known as real estate tax) in hillsborough county is $2,168.00 per year, based on a median home value of. Taxes are assessed by the property appraiser as of january 1 of. The hillsborough county fl property tax rate is $5.7913 per $1,000 of assessed value. Taxes are levied in hillsborough county by the taxing authorities empowered to do so by the state legislature. In unincorporated areas, the total. What is the hillsborough county property tax rate? Locally elected officials florida has more than 640 local governments that levy a property tax. Our hillsborough county property tax calculator can estimate your property taxes based on similar properties, and show you how your property tax. These increases led to an overall county property tax rate increase of about 7 cents per $1,000 in appraised taxable property value. The property appraiser establishes the taxable value of real estate property.

From www.youtube.com

Hillsborough County residents may soon be paying more in property taxes Property Tax Rate In Hillsborough County Fl In unincorporated areas, the total. Taxes are assessed by the property appraiser as of january 1 of. The property appraiser establishes the taxable value of real estate property. The hillsborough county fl property tax rate is $5.7913 per $1,000 of assessed value. The median property tax (also known as real estate tax) in hillsborough county is $2,168.00 per year, based. Property Tax Rate In Hillsborough County Fl.

From avalongrouptampabay.com

Tampa FL Property Taxes AVALON Group Real Estate Agents Property Tax Rate In Hillsborough County Fl Locally elected officials florida has more than 640 local governments that levy a property tax. Our hillsborough county property tax calculator can estimate your property taxes based on similar properties, and show you how your property tax. Taxes are assessed by the property appraiser as of january 1 of. The hillsborough county fl property tax rate is $5.7913 per $1,000. Property Tax Rate In Hillsborough County Fl.

From dailysignal.com

How High Are Property Taxes in Your State? Property Tax Rate In Hillsborough County Fl In unincorporated areas, the total. Taxes are assessed by the property appraiser as of january 1 of. These increases led to an overall county property tax rate increase of about 7 cents per $1,000 in appraised taxable property value. What is the hillsborough county property tax rate? The property appraiser establishes the taxable value of real estate property. The hillsborough. Property Tax Rate In Hillsborough County Fl.

From www.facebook.com

Facebook Property Tax Rate In Hillsborough County Fl In unincorporated areas, the total. The property appraiser establishes the taxable value of real estate property. Taxes are levied in hillsborough county by the taxing authorities empowered to do so by the state legislature. Taxes are assessed by the property appraiser as of january 1 of. What is the hillsborough county property tax rate? Our hillsborough county property tax calculator. Property Tax Rate In Hillsborough County Fl.

From www.floridaforboomers.com

10 Highest (and Lowest) Florida County Property Tax Rates Property Tax Rate In Hillsborough County Fl The hillsborough county fl property tax rate is $5.7913 per $1,000 of assessed value. What is the hillsborough county property tax rate? The property appraiser establishes the taxable value of real estate property. Our hillsborough county property tax calculator can estimate your property taxes based on similar properties, and show you how your property tax. The median property tax (also. Property Tax Rate In Hillsborough County Fl.

From wusfnews.wusf.usf.edu

Nearly 20,000 Hillsborough County Homes Subject to Rise in Flood Property Tax Rate In Hillsborough County Fl Our hillsborough county property tax calculator can estimate your property taxes based on similar properties, and show you how your property tax. The median property tax (also known as real estate tax) in hillsborough county is $2,168.00 per year, based on a median home value of. The property appraiser establishes the taxable value of real estate property. These increases led. Property Tax Rate In Hillsborough County Fl.

From propertyappraisers.us

Hillsborough County Property Appraiser How to Check Your Property’s Value Property Tax Rate In Hillsborough County Fl The property appraiser establishes the taxable value of real estate property. The median property tax (also known as real estate tax) in hillsborough county is $2,168.00 per year, based on a median home value of. Our hillsborough county property tax calculator can estimate your property taxes based on similar properties, and show you how your property tax. What is the. Property Tax Rate In Hillsborough County Fl.

From www.wtsp.com

tax Florida How much you could save Property Tax Rate In Hillsborough County Fl Our hillsborough county property tax calculator can estimate your property taxes based on similar properties, and show you how your property tax. The median property tax (also known as real estate tax) in hillsborough county is $2,168.00 per year, based on a median home value of. What is the hillsborough county property tax rate? The property appraiser establishes the taxable. Property Tax Rate In Hillsborough County Fl.

From libbyqroxanna.pages.dev

When Does Taxes Release 2024 Tami Zorina Property Tax Rate In Hillsborough County Fl Taxes are assessed by the property appraiser as of january 1 of. These increases led to an overall county property tax rate increase of about 7 cents per $1,000 in appraised taxable property value. Taxes are levied in hillsborough county by the taxing authorities empowered to do so by the state legislature. What is the hillsborough county property tax rate?. Property Tax Rate In Hillsborough County Fl.

From 2collegebrothers.com

Hillsborough County Property Taxes 💸 2024 Ultimate Guide & What You Property Tax Rate In Hillsborough County Fl Taxes are levied in hillsborough county by the taxing authorities empowered to do so by the state legislature. In unincorporated areas, the total. These increases led to an overall county property tax rate increase of about 7 cents per $1,000 in appraised taxable property value. The property appraiser establishes the taxable value of real estate property. The hillsborough county fl. Property Tax Rate In Hillsborough County Fl.

From www.chandleraz.gov

Property Tax Reports, Rates, and Comparisons City of Chandler Property Tax Rate In Hillsborough County Fl The property appraiser establishes the taxable value of real estate property. The hillsborough county fl property tax rate is $5.7913 per $1,000 of assessed value. The median property tax (also known as real estate tax) in hillsborough county is $2,168.00 per year, based on a median home value of. These increases led to an overall county property tax rate increase. Property Tax Rate In Hillsborough County Fl.

From 2collegebrothers.com

Hillsborough County Property Taxes 💸 2024 Ultimate Guide & What You Property Tax Rate In Hillsborough County Fl Taxes are assessed by the property appraiser as of january 1 of. What is the hillsborough county property tax rate? Our hillsborough county property tax calculator can estimate your property taxes based on similar properties, and show you how your property tax. Taxes are levied in hillsborough county by the taxing authorities empowered to do so by the state legislature.. Property Tax Rate In Hillsborough County Fl.

From taxfoundation.org

Property Taxes by County Interactive Map Tax Foundation Property Tax Rate In Hillsborough County Fl The hillsborough county fl property tax rate is $5.7913 per $1,000 of assessed value. Taxes are assessed by the property appraiser as of january 1 of. Taxes are levied in hillsborough county by the taxing authorities empowered to do so by the state legislature. These increases led to an overall county property tax rate increase of about 7 cents per. Property Tax Rate In Hillsborough County Fl.

From danyellejwelchxo.blob.core.windows.net

Davis County Property Tax Bill Property Tax Rate In Hillsborough County Fl Our hillsborough county property tax calculator can estimate your property taxes based on similar properties, and show you how your property tax. The property appraiser establishes the taxable value of real estate property. Locally elected officials florida has more than 640 local governments that levy a property tax. Taxes are levied in hillsborough county by the taxing authorities empowered to. Property Tax Rate In Hillsborough County Fl.

From taxfoundation.org

County Property Taxes Archives Tax Foundation Property Tax Rate In Hillsborough County Fl The property appraiser establishes the taxable value of real estate property. Locally elected officials florida has more than 640 local governments that levy a property tax. The hillsborough county fl property tax rate is $5.7913 per $1,000 of assessed value. In unincorporated areas, the total. Taxes are levied in hillsborough county by the taxing authorities empowered to do so by. Property Tax Rate In Hillsborough County Fl.

From www.johnlocke.org

Twentyfour Counties Due for Property Tax Reassessments This Year Property Tax Rate In Hillsborough County Fl Taxes are levied in hillsborough county by the taxing authorities empowered to do so by the state legislature. Our hillsborough county property tax calculator can estimate your property taxes based on similar properties, and show you how your property tax. What is the hillsborough county property tax rate? Taxes are assessed by the property appraiser as of january 1 of.. Property Tax Rate In Hillsborough County Fl.

From www.tampahomessold.com

hillsboroughcountyflmap1024x690 Property Tax Rate In Hillsborough County Fl The property appraiser establishes the taxable value of real estate property. What is the hillsborough county property tax rate? The median property tax (also known as real estate tax) in hillsborough county is $2,168.00 per year, based on a median home value of. Taxes are assessed by the property appraiser as of january 1 of. These increases led to an. Property Tax Rate In Hillsborough County Fl.

From 2collegebrothers.com

Hillsborough County Property Taxes 💸 2024 Ultimate Guide & What You Property Tax Rate In Hillsborough County Fl Our hillsborough county property tax calculator can estimate your property taxes based on similar properties, and show you how your property tax. The hillsborough county fl property tax rate is $5.7913 per $1,000 of assessed value. Locally elected officials florida has more than 640 local governments that levy a property tax. Taxes are assessed by the property appraiser as of. Property Tax Rate In Hillsborough County Fl.